Yesterday saw something rather familiar for 2015 take place as we saw this announced by the Reserve Bank of India.

reduce the policy repo rate under the liquidity adjustment facility (LAF) by 50 basis points from 7.25 per cent to 6.75 per cent with immediate effect;

If we just look at India we see that this has become a regular event in 2015 as the RBI confirms.

the 75 basis points of the policy rate reduction during January-June.

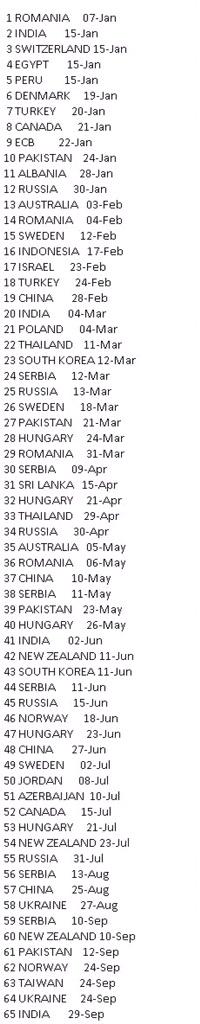

I will return to the Indian situation in a moment but we are in the 60s in terms of interest-rate cuts this year. Odd in what was supposed to be a year of economic recovery is it not? What are they worried about? Here is the list kindly provided by @moved_average.

One can to and fro over individual instances as I would argue that the ECB move in January was a quantity easing via QE rather than an interest-rate cut although of course it had quite an impact on longer-term interest-rates via bond yields.

What about India?

This is an interesting (sorry!) case as of course we are reviewing what is supposed to be one of the fastest growing areas of the world economy. So let us remind ourselves of what the RBI expects to see.

Growth in real GVA (Gross Value Added) at basic prices is expected to be around 7.0 per cent in Q3 of 2015-16 before firming up to around 7.6 percent in Q4 with risks evenly balanced around this projection . Real GVA growth is expected to pick up gradually in 2016-17 on a shallow cyclical upturn, driven by an expected normal monsoon and some improvement in external demand,

The first thing we need to do is recalibrate our settings as the current 7% growth rate is considered a disappointment in India. But I note that a pick-up is expected so the RBI could have slapped itself on the back for its past policy moves and done nothing. However the RBI in fact decided to do this.

Therefore, the Reserve Bank has front-loaded policy action by a reduction in the policy rate by 50 basis points.

A pre-emptive cut returns us to the theme of what are they afraid of? It also makes me wonder if their forecasts are subject to some rose-tinting like so many other official forecasts. The obvious thought is that they are preparing themselves for any disruption caused by the interest-rate rises promised by the US Federal Reserve and to a lesser extent the Bank of England. Awkward if they do not actually arrive as we know that they have been delayed suffering from leaves on the line for quite a while now.

What about the world outlook?

The RBI suggests that there are plenty of problems here.

Since the third bi-monthly statement of August 2015, global growth has moderated, especially in emerging market economies (EMEs), global trade has deteriorated further and downside risks to growth have increased.

It does not take long for blame to be apportioned.

Since the Chinese devaluation, equity prices, commodities and currencies have fallen sharply.

Also the RBI focuses on something which does not get reported widely.

In the United States, industrial production slowed as capital spending in the energy sector was cut back and exports contracted, weighed down by the strength of the US dollar.

US industrial production ended 2014 at 107.5 where 2012 = 100 and was 107.1 in August. Now whilst there has obviously been a downwards drag from mining (especially shale oil and gas) manufacturing has only edged forwards from 104.9 to 105.3 so it is more complicated than that. Also readers may recall the downwards revisions to US industrial production which took place not so long ago but again were swept under the carpet in news terms. From the US Federal Reserve.

However, the gains in 2012 and 2013 are each 1 percentage point weaker than previously stated, putting the trajectory of the recovery on a lower path.

At one point in its review the RBI has us reaching for a pack of economic anti-depressants!

EMEs are caught in a vortex of slowing global trade volumes, depressed commodity prices, weakening currencies and capital outflows, which is accentuating country-specific domestic constraints.

I think that “depressed commodity prices” is something of a misnomer. After all whilst they have fallen many are still at relatively high levels also for many countries they will provide a boost. For example India is a very large importer of oil and has used the price of it as an excuse/reason for its persistent trade deficit. However the August trade figures showed that the lower oil price had reduced the value of India’s oil imports by 39%. If we move to coal and coke ( the carbon version here….) the value of imports has fallen by 18% and iron and steel by 12%. Now for the latter the experience of Redcar SSI in the UK shows us that there have also been volume contractions but the oil change is one of prices and is a large gain for India.

Is it the banks?

It would appear that a familiar theme is playing out as banks do not pass on interest-rate cuts in some areas.

The median base lending rates of banks have fallen by only about 30 basis points despite extremely easy liquidity conditions. This is a fraction of the 75 basis points of the policy rate reduction.

But do so with great enthusiasm in others.

Bank deposit rates have, however, been reduced significantly,

It is a shame that they do not specify the “significantly”…

A familiar theme

At a time like this it is particularly important to be sure of your data. That message does not appear to have reached the official statisticians.

Concurrent indicators also suggest that the new GDP series shows higher growth than would the old series,

There were changes too for the inflation numbers as the water gets ever muddier. All of that is before we get to the issue of corruption and the black market in India which even its best friends would quietly admit is rife.

Inflation

If we move to the Euro area we get another insight into the machinations of the inflation and interest-rate debate. From Eurostat this morning.

Euro area annual inflation is expected to be -0.1% in September 2015,

That will resonate at the ECB because some of its forwards looking indicators are dipping too. Now some care is needed because services inflation is running at 1.3% as we observe goods disinflation mostly driven by oil prices but nonetheless the headline is what it is.

China

Not an interest-rate cut but yet another extraordinary monetary measure. From Bloomberg.

China cut the minimum down payment requirement for first-time homebuyers, stepping up support for the property market amid an economic slowdown.

The reduction to 25 percent (from 30%).

I guess if all else fails there is always the housing market.

Comment

One factor in the actions of emerging markets interest-rate cuts has been fear of an interest-rate rise in the US something the IMF seems to be mounting a particular scaremongering campaign about.

Emerging markets must prepare for the adverse domestic stability implications of global financial tightening.

Oh and its discussion of the problems of lack of market liquidity can mostly be explained by all the QE policies which have driven liquidity lower. At this point the IMF may start displaying some of the characteristics of HAL-9000.

Meanwhile let us touch base with one of those who keeps promising to raise interest-rates and be part of the “global monetary tightening” Bank of England Governor Mark Carney.

There is a growing international consensus that climate change is unequivocal…..Evidence is mounting of man’s role in climate change. Human drivers are judged extremely likely to have been the dominant cause of global warming since the mid-20th century

Forward Guidance for the weather and climate Mark? I note that he has later left himself a get out clause with “temporary fluctuations” used. After all we know that temporary can cover as long a period as they like!

Also we have two issues. One is of a man who asked for his term to be shortened from 7 to 5 years telling us about the ultra-long-term. The other is the reliability of the Bank of England as yet another scandal emerges, Still I suppose he cannot be proven wrong during his term! Unlike on interest-rates….

Hi Shaun,

Excellent take as usual, especially the list of interest rate reductions.

I wouldn’t be surprised if the Fed’s next move early in 2016 is more QE. Industrial output is dropping, profit warnings are increasing, the stock market is getting increasingly bearish, all things you don’t need when it’s that ‘it’s the economy stupid’ time again with presidential elections on the horizon. If pumping up the QE volume to 11 is seen as helping the incumbent’s parties heading towards November 2016, why wouldn’t you?

Hi Rods and thank you

There is much to consider as for example some think that the US industrial production numbers signify a recession. I agree but in the oil and gas sector! Elsewhere it has to be seen but there were some issues with the numbers which came out later today. From Bloomberg.

“Surveys conducted by regional Federal Reserve banks signal that U.S. manufacturers came under severe stress in September.

Seven of these surveys have been released over the course of the month, and only one, the Dallas Fed Manufacturing Index, has exceeded economists’ expectations.

All these regional surveys pointed to shrinking manufacturing sectors, with some prints coming in at their worst levels since the Great Recession:”

So QE4 may be nearer than an interest-rate rise which I have argued plenty of times before. I also wouldn’t rule out some sort of combination.

I do get some amusement we cannot raise rates as mountains of debt. Then UK Govt produces a budget surplus that relies on ever higher mountains of debt. To me it seems like a giant game of Jenga where removed tiles are added on top.

Beginning to wonder how long before debt jubilees and PQE style stuff are the policy not of a so called left [John McDonnell/Corbs the new neo Libs who knew] unwilling to challenge orthodoxy but Osborne, Varney, Yellen et al.

Hi Bedfont

I think that you mean budget deficit rather than surplus. As to official policy I agree and would not be surprised to see more QE which would include ever more private-sector assets. A bit like in Japan where they have been buying equity and property based funds for a while now.

So as predicted we enter another deflationary period and the previous years in which we could( or they could have ) have done something to bulwark the economy

nothing has changed has it ?

Well the rich are richer and the Banks are still bust

So what to do?

Japan has had 20 years of QE and got little return for it .

We cant spend a few bob to save a steel plant or any other “real” industry , but we can thrwo money at the Banks

Well pull up a chair , Shaun, QE and MIRP is on it way

have some popcorn ….

Forbin

PS: They are insane , aren’t they ?

Insanity: doing the same thing over and over again and expecting different results.

Albert Einstein

QE and MIRP … there’s your bulwarks right there, forbin old chum.

Utter bulwarks.

BTW, it’s official; Mr Carney is now the world’s highest-paid weatherman.

They may well be insane but, unfortunately for us, they are also in charge!

Hi Jim:

“BTW, it’s official; Mr Carney is now the world’s highest-paid weatherman.”

__________________________________

A similar accuracy of forecast, perhaps.

How often do they miss a storm?

Hi Jim M and Forbin

I thought that you might like a little musical accompaniment to your theme.

Hi Shaun and thanks for the blog.

So many rate cuts and some from countries who are doing quite well.

Modi in India has been criticized for carrying out reforms too slowly. The honeymoon period seems to be truly over.

I see the Indian government has cut natural gas prices, from 1st Oct. by some 18%.UK take note.

On another theme I was amused by Nationwide whilst announcing that the average house price is creeping towards £200k stated that price rises were normalising with wage increases.

ah, “normalising” meaning in this case that wages are falling behind any house price increase

Tell me Shaun , when my house is worth 3 million quid , would it be worth it to sell up and move to India ?

Cheers

Forbin

Working in India my wife had her own hut on the beach for £3 a night and she could not spend £1 a day on food and beer. So your house sale proceeds might well see you out. Of course you would be an immigrant…

Indeed the deflation is back…Needing to know the basic concepts of economics is very vital in finding out the economic scenario…..I have a blog which takes care of this issue. Just have a look on my website-https://understandingbasiceconomics.wordpress.com

Hi Alan and good luck with your blog.

However whilst the US has seen some disinflation in 2015 it is not yet in deflation according to the official numbers. Both inflation and output and indeed wages are positive right now.

Hi Shaun

Your rhetorical headline says it all. The picture we get from the MSM and even the central banks is, to my mind quite misleading. If you follow the detailed news (most don’t) you know that things have been softening for quite a while.

If we are indeed in a slowdown, or worse, the this will merely compound the problems by ratcheting up the debt burden, both public and private, and drive us further into the interest rate box where IRs cannot be raised. It’s a one way street but many have still not figured this out yet.

Hi, Bob J

I’ve been saying on here for some time that the longer we have Zirp, the harder it will be to raise them.

Hi Shaun, who says the outlook is good? Even the IMF are complaining about a future of mediocre/no growth if Policy makers don’t make politically unpopular structural changes, so we know what the answer to that will be.

Hi Noo2

I think that the IMF are conflicted right now as their rush to drop hints not to raise interest-rates to the US Fed are controlling matters. However the World Trade Organisation was optimistic today.

“WTO economists have lowered their forecast for world trade growth in 2015 to 2.8%, from the 3.3% forecast made in April, and reduced their estimate for 2016 to 3.9% from 4.0%.”

A downgrade yes but better than many others think…..

You cannot taper a ponzi scheme !!

There you go again Shaun; upsetting my day by talking about the banks.

Great stuff, keep it up. Don’t let them off the hook. Not for a moment.